Soaring packaged food sales gives industry three healthier options: Euromonitor

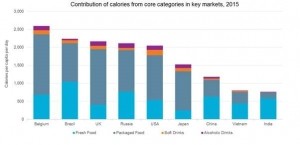

Market researchers at Euromonitor looked at consumption data for 54 countries in both developed and developing regions and broke down the calorie intake according to category, looking at fresh food, packaged food, soft drinks and alcoholic drinks.

Belgium purchases the most calories globally with an average total of 2,597 kcal per capita per day, followed by Brazil, the UK, Russia and then the US.

In 2015, 85% of researched countries consumed more calories from packaged food as opposed to fresh food, while of the countries the market research company tracks, India purchases fewest calories (762 kcal per capita per day).

“The rule of thumb is that the more economically advanced the country the more dependent on convenience foods it is," nutrition analyst at Euromonitor International Sara Petersson said. "Therefore, we see in our data that packaged foods dominate in terms of calories consumed as opposed to fresh foods primarily in developed markets.”

Three ways to make your packaged portfolio healthier

But this is not necessarily a bad thing for public health, says Petersson, who sees it as an opportunity for industry to make packaged food healthier.

“In essence manufactures have three ways to go: they can maintain the product recipe and reduce the size which - as we have seen in the recent news – comes with a risk of consumer backlash and being accused of ‘ripping people off’," she told FoodNavigator.

Food packaging analysts at Euromonitor have also found that in some cases, reducing packaging size can actually promote an increase in volume sales, meaning downsizing is not always effective in cutting consumption.

“Secondly, they can reformulate, which can be more or less tricky depending on product category. Food and drink manufactures reduce the sugar, salt or fat content all the time. Often, if the taste changes significantly, this leads to a drop in sales. This is not to say that the consumer is suddenly eating any better. Instead, they often turn to other similar products, which satisfy their craving. For real change in consumption to occur, we would need all brands to reformulate equally.

“Lastly, manufacturers can invest in healthier food and drink categories. In developed markets there is a definite move away from sweet snacks such as cakes, biscuits, or chocolate confectionery. We’re seeing an increasing movement of food manufacturers, who mostly focus on sweet foods, investing into healthier and/or savoury products.”

Recently there have been a number of examples of firms doing this. General Mills acquired Epic bars and PepsiCo tried to buy Chobani in 2016.

Last year French dairy giant Danone bought WhiteWave in a $12.5bn (€11.7bn) deal to strengthen its presence in plant-based and organic food categories.

The drive to make portfolios healthier is even being felt in the confectionery category.

The market research firm says the healthy chocolate category – which includes fortified, functional, organic, reduced fat and sugar chocolate, is set to grow at twice the pace of the regular category over the next four years, with a projected compound annual growth rate (CAGR) of +2.6%, compared to a +1.3% for the 2016 to 2021 period.

In 2015, meanwhile, Hershey acquired meat jerky brand Krave.

A global push towards healthy is needed

But do rising obesity rates suggest that healthy reformulation is not happening fast enough? Yes and no, says Pettersson.

“The food and drink industry is dealing with a lot of pressure from governments, and both semi-enforced and voluntary reformulations are certainly happening. They could occur faster but, more importantly, they should occur on a more global scale and in a more standardized way" she says.

“As long as there is an alternative providing the consumer with what they want, that is what they will go for. On the other hand, removing all ‘unhealthy’ options from the market seems a bit extreme - consumers want choice.”