'The best kind of bad': Chocolate makers need premium ingredients not sugar reduction

The snacking market is expanding to yogurts, milk drinks, energy bars and nuts driven by a consumer backlash against sugar, salt and artificial ingredients, as well as changing lifestyles, global lead analyst at Euromonitor, Lianne van de Bos, said during the recent Consumer Analyst Group Europe (CAGE) conference hosted in London, UK.

The analyst urged chocolate makers to focus on quality ingredients to ensure the category stands out.

Premium indulgence

“Before it was reducing sugar, now it’s about high-quality ingredients, better taste, and moderation. Some of the current value gain strategies in chocolate have been centered around its attributes.

“Big successes have been booked by the sudden popularity of dark chocolate, which is positioned as a healthier alternative to other types of chocolate,” she added. “If you’re going to go for chocolate, which we know is bad, better go for the best kind of bad," she said.

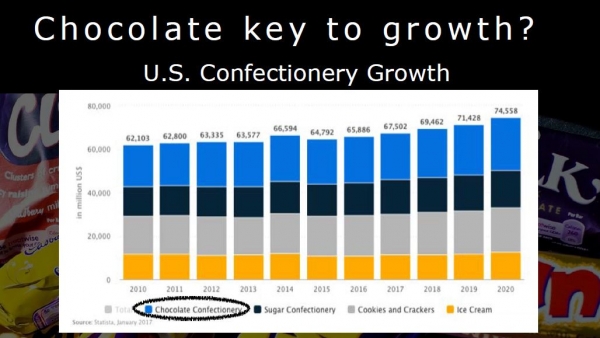

Euromonitor predicts yogurt and sour milk products will make up 15.8% of the snack market in 2021, up from 11.1% in 2002, while chocolate confectionery’s share of snacks will decrease from 17.9% in 2002 to 16.2% in 2021.

Instead of competing against healthier snacks with reduced calories, van de Bos further suggested chocolate manufacturers can learn lessons from coffee’s growth strategy which turned a simple drink into a little luxury.

“In that sense, chocolate has a role to play to position itself towards mental wellbeing, a moment of premium indulgence,” she said.

“When selling premium chocolate, consumers need to be educated on premium ingredients, cocoa content and origin, something for which foodservice outlets are a great point of contact," the analyst continued.

Evolved consumer demands

Van de Bos said startups had tapped into personal wellbeing and changing lifestyles quicker than big food companies, eating up their market share.

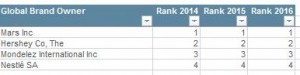

“2016 saw a dip in the combined share of the top 20 companies, after years of growth,” van de Bos said.

However, Mars, Hershey, Mondelez and Nestlé, are still the top four US confectionery players in terms of market share, according to Euromonitor data.

Chocolate remains one of the top snacking options

A recent Nielsen survey, conducted over 30 days, showed chocolate is the number one snacking option globally with about 64% of the surveyed consumers choosing chocolate as their preferred snack, followed by cookies and biscuits, bread and sandwich, chips and crisps, nuts and seeds.

In North America, chips and crisps surpassed the chocolate as the top snacking option, with 63% of consumers’ support, versus 59% respondents choosing chocolate, the survey indicated.